At the time, the consensus view was that growth in wages and employment were accelerating and that this would soon lead to a meaningful increase in inflation above the Fed's 2% target. Our monthly review of the data has consistently shown this expectation to be premature.

This post updates the story with the data from the past month. We are now starting to see consistently better growth. Highlights:

- In the past 12 months, the average monthly gain in employment has been 275,000, the highest since 1994

- Despite improving employment, there hasn't been any notable sustained acceleration in wages

- Real personal consumption (70% of GDP) grew 3.4% in January, the highest rate of growth in 8 years. Real retail sales grew 3.5%

- The manufacturing component of industrial production grew 6.0% in January, the highest rates in 4 years

- New home sales were the highest in 7 years for the second month in a row

- However, the inflation rate continues to decelerate. It has fallen to its lowest level since 2009

Let's review each of these points in turn. We'll focus on four categories: labor market, inflation, end-demand and housing.

Employment and Wages

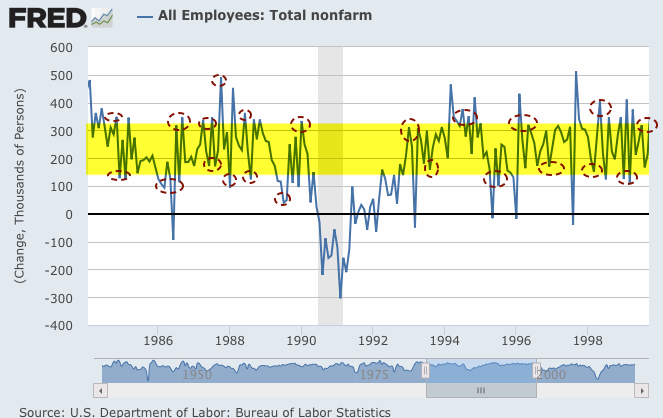

The February non-farm payroll (295,000 new employees) followed the incredible 423,000 in November. NFP has been above 200,000 every month for 12 months in a row. It hasn't been above 200,000 that many months in a row since 1993-95.

In the past 12 months, the average gain in employment was 275,000, the highest since 1994.

What is noteworthy is that monthly NFP prints are normally volatile. Since 2004, NFP prints near 300,000 have been followed by ones near or under 200,000 (circles). That has been a pattern during every bull market. The consistent strength in monthly NFP recently is simply remarkable.

For this reason, it's better to look at the trend; in February, trend growth was 2.4% yoy, the highest since May 2000. The trend in NFP employment has not much exceeded 2% growth yoy since 2000, so the strength of the recent trend is noteworthy.

The employment cost index shows modest growth in compensation, but the trend is clearly improving. For 4Q14, it was 2.3% yoy, the highest since the recession; this is good news, especially as there is a trend of sequential quarterly improvements.

Inflation

Despite improving employment, inflation has been decelerating in recent months and remains well below 2%.

With oil prices collapsing, CPI dropped to -0.2% in January, the lowest since 2009. The more important core CPI (excluding more volatile food and energy) grew 1.6%, unchanged from last month. Consensus expectations are that inflation will accelerate but it hasn't happened.

The Fed prefers to use personal consumption expenditures (PCE) to measure inflation; total and core PCE were 0.2% and 1.3% yoy, respectively, in January . Neither has been above 2% since 2Q 2012. Like CPI, there has been no sustained acceleration in inflation, and the rate is well below levels in 2003-07.

For some reason, many mistrust CPI and PCE. MIT publishes an independent price index (called the billion prices index). It tracks both CPI and PCE closely.

Demand

Next, let's look at several measures of demand growth. Regardless of which data is used, real demand has been growing at about 2-3%, equal to about ~3-4% nominal.

On an annual basis, real (inflation adjusted) GDP growth through 4Q14 was 2.4%. 4Q growth was slightly above the middle of the post-recession range (1.5-3.0%). It's positive, but lower than what the US is used to; prior expansionary periods since 1980 experienced growth of 2.5-5% yoy. There's no obvious acceleration taking place.

Stripping out the changes in GDP due to inventory produces "real final sales". This is a better measure of consumption growth than total GDP. In 4Q14, this grew 2.3% yoy, down from 2.8% in 3Q14 which was the highest in 8 years (since 4Q 2006). A sustained break above 2.5% would be noteworthy. Not yet.

Similarly, the "real personal consumption expenditures" component of GDP (defined), the component which accounts for about 70% of GDP, grew at 2.8% yoy in 4Q14, at the high end of its post-recession range (2-3%). This is approaching, but still below, the 3-5% that was common in prior expansionary periods after 1980.

A new bright spot: on a monthly basis, the growth in real personal consumption expenditures was 3.4% yoy in January, the highest rate of growth since October 2006, more than 8 years ago.

Real retail sales grew 3.5% yoy in the past month. The latest print was the third highest in the past 3 years (since February 2012). The range has been 1.5-4% yoy for most of the past 20 years.

Core durable goods orders (excluding military, so that it measures consumption, and transportation, which is highly volatile) grew at 4.0% yoy (nominal) in January. During the heart of the prior bull market, growth was typically 7-13%.

In January, industrial production growth was near the top of the range at 4.8%. The manufacturing component (excluding mining and oil/gas extraction) grew 6.0%, the highest rate since February 2011. The typical range for annual growth in Industrial Production has been 1.5-5% through the past 15 years. During much of the 1990s, the range was higher: 3.5-7%.

Housing

Finally, let's look at two measures of housing. Housing data continues to improve but the levels of construction and sales are small relative to prior bull markets.

First, new houses sold was 481,000 in January. Sales the past two months are the highest since mid-2008, 7 years ago. The overall level of sales is still meager relative to prior bull markets. 30 years ago, 600,000 would have been at the low end of the range for monthly sales.

Second, overall starts in January were the 5th highest in the past 6 years. The overall level of construction is well off those during the prior two bull markets, but the trend is positive.

Single family housing starts in January were the 3rd highest since the recession (blue line). Meanwhile, multi-unit housing starts (red line) were the 4th highest.

Summary

In summary, the major macro data so far suggest positive, but modest, growth. But the trend is clearly improving. This is consistent with corporate sales growth. SPX sales growth the past year has been positive but only 3.3% (nominal).

The consensus expects sales growth of about 2-4% per annum (nominal) thru 2016, excluding the volatile energy sector; the macro data presented here makes this seem reasonable.

With valuations at high levels, the current pace of sales growth is likely to be the limiting factor for equity appreciation. This is important, as the consensus expects earnings to grow at 3% in 2015 and 13% in 2016.

Modest growth should not be a surprise. This is the classic pattern in the years following a financial crisis like the one experienced in 2008-09. It is also what the flattening spread in yields had been signaling for all of 2014. There are signs that this may now be reversing in 2015.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.